Limited Liquidity: Lots of the alternative assets that could be held in an SDIRA, for example real-estate, private equity, or precious metals, may not be effortlessly liquidated. This may be a concern if you should access resources speedily.

While there are numerous Gains affiliated with an SDIRA, it’s not with out its have negatives. Some of the popular explanation why traders don’t select SDIRAs include things like:

An SDIRA custodian is different given that they have the suitable staff members, experience, and capacity to take care of custody in the alternative investments. The initial step in opening a self-directed IRA is to locate a service provider that is certainly specialised in administering accounts for alternative investments.

Before opening an SDIRA, it’s essential to weigh the possible positives and negatives dependant on your specific financial objectives and danger tolerance.

The tax advantages are what make SDIRAs eye-catching For numerous. An SDIRA may be the two classic or Roth - the account form you end up picking will count mostly on your own investment and tax system. Look at with your economic advisor or tax advisor in case you’re unsure which happens to be greatest in your case.

Entrust can support you in acquiring alternative investments with all your retirement money, and administer the obtaining and promoting of assets that are usually unavailable by financial institutions and brokerage firms.

A self-directed IRA is surely an very potent investment car or truck, but it’s not for everyone. Since the expressing goes: with fantastic electrical power arrives good obligation; and having an SDIRA, that couldn’t be a lot more correct. Keep reading to learn why an SDIRA could possibly, or won't, be in your case.

Sure, property is among our purchasers’ hottest investments, at times called a property IRA. Clientele have the option to take a position in all the things from rental Houses, industrial property, undeveloped land, mortgage loan notes and much more.

Earning the most of tax-advantaged accounts enables you to retain far more of the money you spend and gain. Retirement-focused bullion providers Dependant upon whether you decide on a conventional self-directed IRA or maybe a self-directed Roth IRA, you've got the possible for tax-totally free or tax-deferred advancement, furnished selected conditions are fulfilled.

As a result, they have an inclination not to promote self-directed IRAs, which supply the flexibleness to invest in a very broader array of assets.

Irrespective of whether you’re a economical advisor, investment issuer, or other money Specialist, check out how SDIRAs may become a robust asset to mature your small business and attain your Expert aims.

Customer Guidance: Search for a service provider which offers dedicated assist, together with entry to proficient specialists who will answer questions about compliance and IRS principles.

Real-estate is one of the most popular options among SDIRA holders. That’s simply because it is possible to invest in any kind of real-estate having a self-directed IRA.

The leading SDIRA guidelines with the IRS that traders have to have to know are investment limitations, disqualified folks, and prohibited transactions. Account holders must abide by SDIRA guidelines and rules so as to maintain the tax-advantaged standing of their account.

No, You can not invest in your own business enterprise by using a self-directed IRA. The IRS prohibits any transactions in between your IRA as well as your individual enterprise as you, because the proprietor, are considered a disqualified particular person.

Selection of Investment Choices: Make sure the supplier enables the kinds of alternative investments you’re keen on, including real estate, precious metals, or personal fairness.

Larger investment choices suggests you are able to diversify your portfolio outside of shares, bonds, and mutual funds and hedge your portfolio in opposition to current market fluctuations and volatility.

Quite a few buyers are astonished to learn that working with retirement resources to take a position in alternative assets has actually been attainable because 1974. On the other hand, most brokerage firms and banking companies give attention to giving publicly traded securities, like stocks and bonds, because they lack the infrastructure and experience to manage privately held assets, including real-estate or private equity.

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the goal of earning fraudulent investments. They normally idiot investors by telling them that When the investment is accepted by a self-directed IRA custodian, it should be reputable, which isn’t true. All over again, Make sure you do comprehensive homework on all investments you decide on.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Mara Wilson Then & Now!

Mara Wilson Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Molly Ringwald Then & Now!

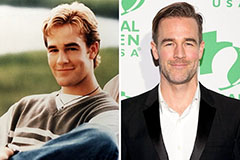

Molly Ringwald Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!